6,000+ Merchants Worldwide Trust ShipperHQ

Transparent Checkout. More Conversions. Fewer Returns.

43% abandon cart when they can't see total costs upfront – including duties & taxes. Capture more international sales and cut costly returns with transparent landed costs at checkout.

Duties & Taxes on Autopilot

Expand globally without the complexity. ShipperHQ automatically calculates duties, tariffs, and taxes – adapting to changing trade policies in real-time so your landed costs stay accurate, no matter what.

Choose DDP or DDU. Collect duties at checkout (DDP) or display estimates (DDU).

Choose DDP or DDU. Collect duties at checkout (DDP) or display estimates (DDU). No HS Codes needed. You can add HS codes for greater precision, but they’re not required.

No HS Codes needed. You can add HS codes for greater precision, but they’re not required. Comply better with global regulations. Scale internationally without legal headaches.

Comply better with global regulations. Scale internationally without legal headaches. Avoid getting locked in to a specific carrier. Works with any global carrier – DHL, UPS, FedEx, USPS, and more.

Avoid getting locked in to a specific carrier. Works with any global carrier – DHL, UPS, FedEx, USPS, and more. Ensure reliable and accurate rates with real-time calculations powered by DHL.

Ensure reliable and accurate rates with real-time calculations powered by DHL.

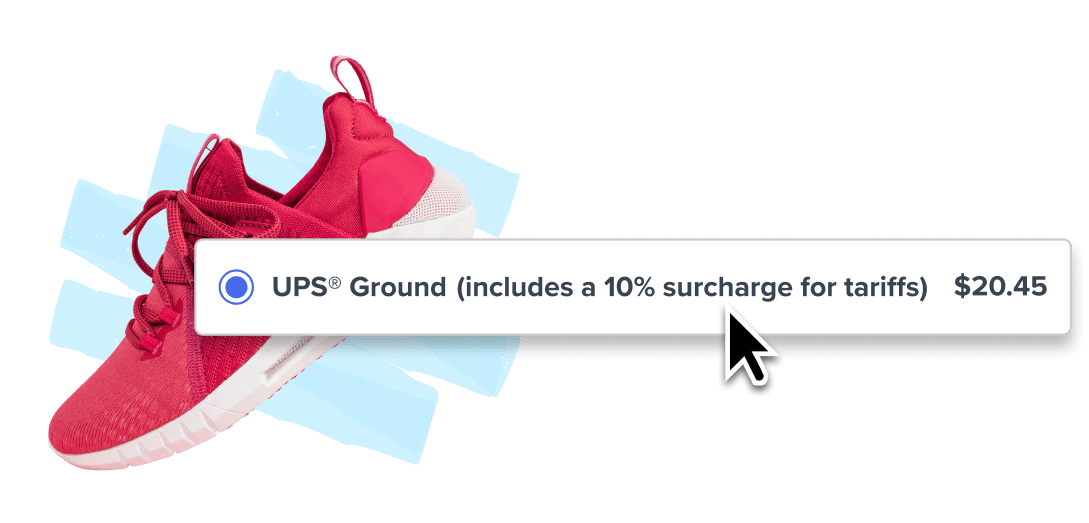

Tackle tariffs with shipping rules

With Shipping rules you can add a custom tariff fee at checkout to offset import costs and build customer trust. Book a quick demo to see how easy it is to set up.

Say Goodbye to Costly Global Returns

Did you know that nearly half of customers who are charged unexpected duties or taxes after checkout refuse delivery?

Prevent unexpected fees by displaying and collecting total landed costs upfront.

Prevent unexpected fees by displaying and collecting total landed costs upfront. Reduce international returns with transparent pricing.

Reduce international returns with transparent pricing. Kick up delivery success rates by ensuring all duties and taxes are paid for or displayed at checkout.

Kick up delivery success rates by ensuring all duties and taxes are paid for or displayed at checkout.

“We have been able to tailor our shipping methods to our needs for both domestic and international orders, which makes our shipping process smoother and more streamlined.”

Tim Bombeli, Project Manager, MakingCosmeticsDeliver a Better Experience for Customers Everywhere

Build trust across borders with a smooth, transparent checkout.

Increase repeat purchases by preventing surprise fees and delays.

Increase repeat purchases by preventing surprise fees and delays. Drive more positive reviews and prevent negative ones.

Drive more positive reviews and prevent negative ones. Decrease support burden with fewer customer service inquiries about import fees.

Decrease support burden with fewer customer service inquiries about import fees. Improve conversions by displaying total costs clearly – no hidden fees.

Improve conversions by displaying total costs clearly – no hidden fees.

Why Merchants Choose ShipperHQ for Duties & Taxes

Highly accurate calculations powered by DHL, the global leader in international shipping

Compatible with every global carrier across 200+ countries

Access to ShipperHQ’s full solution for full control over shipping and checkout

Pays for itself - automatically add a service fee to duty and tax estimates to recover costs

No code, no additional subscriptions, no HS codes required

“Our integration with ShipperHQ empowers online merchants to boost international sales while effortlessly navigating the complexities of international shipping.”

Lee Spratt, CEO, DHL eCommerce Book a demo

FAQs

How can I estimate international shipping costs for my online store?

You can enable the Duties & Taxes feature in ShipperHQ to show fully landed costs for international orders right at checkout. These include shipping, duties, taxes, and import fees, so your customers know exactly what they’ll pay before they complete their purchase.

At checkout, ShipperHQ calculates the total landed cost for cross-border orders based on the destination country, product details, and shipping method.

Using Duties & Taxes feature, you can:

- Display duties and taxes alongside shipping for cross-border orders

- Choose whether to charge duties at checkout or let the customer pay on delivery

- Improve transparency for international shoppers without relying on unverified third-party tools

- Work seamlessly with any global carrier

What carriers and eCommerce platforms are compatible with ShipperHQ's Duties & Taxes feature?

ShipperHQ’s Duties & Taxes feature, powered by DHL eCommerce, is carrier-agnostic and works with any international carrier. You can use it with a wide range of providers including UPS, USPS, FedEx, DHL, and other international carriers, across shipments to over 200 countries.

Duties & Taxes is available for merchants on all major platforms including Shopify, BigCommerce, Adobe Commerce and Magento. If you're on a custom or less-common platform, you can also integrate it using ShipperHQ’s SDK kit.

What are the requirements for using the Duties & Taxes feature?

To use ShipperHQ’s Duties & Taxes feature, you must be on the Advanced or Enterprise plan and have the feature enabled in your account. Once activated, setup involves a few key steps to ensure accuracy at checkout:

- Enable international shipping methods and select a default country of origin

- Configure your preferences for how duties and taxes are calculated and shown at checkout

- Assign HS codes to your products for accurate duty and tax calculation

- Set up billing for the Duties & Taxes add-on in your ShipperHQ account

These steps ensure shoppers see accurate landed costs at checkout before placing the order.

Is the Duties & Taxes feature included in my ShipperHQ plan?

No. Duties & Taxes is an add-on to your base ShipperHQ subscription and is not included by default. It does not count against your ‘Advanced Feature’ limit.

To enable it, you must be on ShipperHQ’s Advanced or Enterprise plan. The feature is billed separately in addition to your main subscription.

If you're using Shopify, activating Duties & Taxes requires switching from Shopify billing to ShipperHQ's own billing system.

Do I need to manage HS codes in ShipperHQ to calculate the total landed cost accurately?

No. Harmonized System (HS) codes are not required to use the Duties & Taxes feature. ShipperHQ can calculate duties and taxes without them, making setup faster and easier.

However, adding HS codes for your products improves the accuracy of duty and tax calculations because it helps classify items correctly for customs. You can get started without them and refine over time.

Can I choose whether duties and taxes are collected at checkout or paid on delivery?

Yes. ShipperHQ’s Duties & Taxes feature gives you control over how duty and tax calculations are handled at checkout. You can choose between:

- Delivery Duty Paid (DDP): Duties and taxes are calculated and collected at checkout, so the customer pays the full landed cost upfront.

- Delivery Duty Unpaid (DDU): You display an estimate at checkout, but the customer is responsible for paying duties and taxes upon delivery.

This allows you to align the checkout experience with your business model and your customers' expectations.

Grow Internationally Without the Complexity

With ShipperHQ, you’ll deliver a transparent checkout that helps you scale globally – increasing cross-border conversions, reducing returns, and building customer loyalty.